Many of us have a hard time talking to our kids about a variety of issues — including finances. However, it makes sense to talk to our kids about the things they need to know later in life.

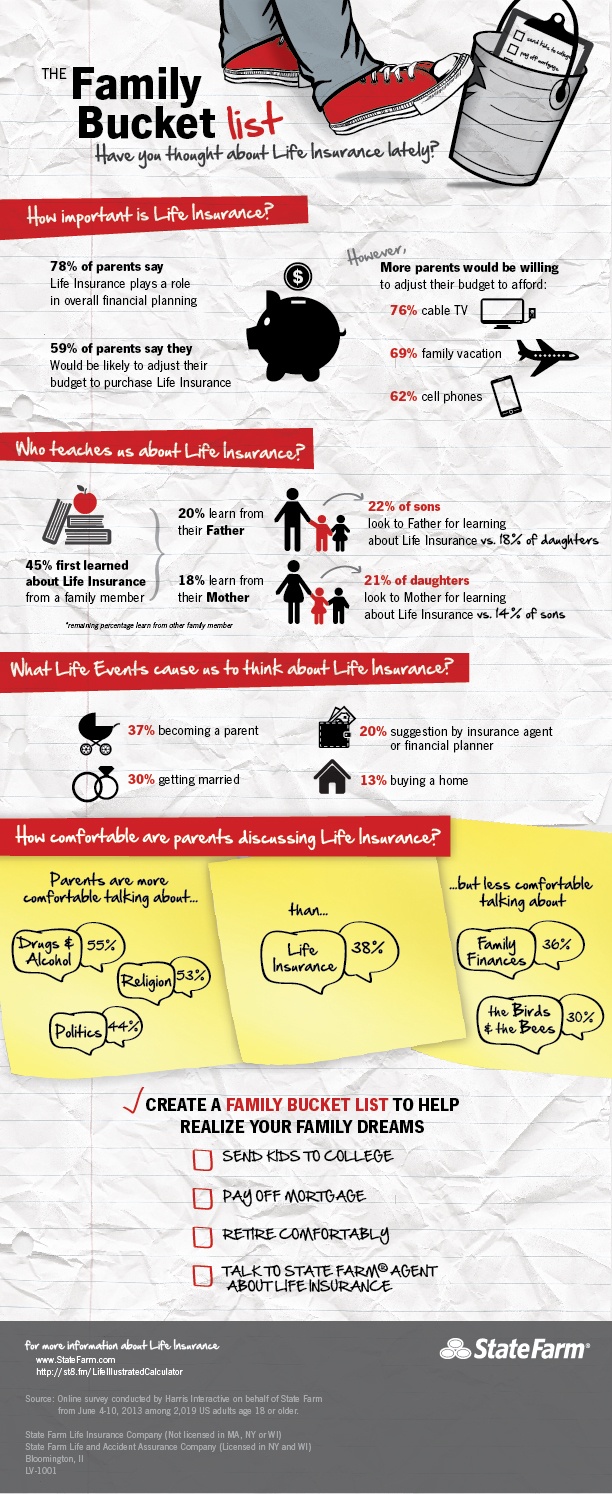

This infographic from State Farm offers an interesting look at our relationships with life insurance, and how many parents are willing to talk to their kids about life insurance.

Are You Talking About Money with Your Kids?

The information from this infographic that I found most interesting is located at the bottom. First of all, I found it interesting that parents are more comfortable talking about drugs and alcohol than they are talking to their kids about finances. Indeed, 55 percent of parents are comfortable talking about drugs and alcohol while only 36 percent are comfortable talking about the family finances (38 percent are comfortable talking about life insurance).

I guess part of the reason it’s easier to talk about drugs and alcohol is due to the fact that it’s pretty clear cut that these are wrong and, for teenagers, illegal. It’s not an easy conversation, but it’s sometimes easier than discussing family finances. In fact, with drugs and alcohol, it’s more of a conversation about expectations, and it’s very one-sided. You tell your kids drugs and alcohol are dangerous at their age, and you impose consequences for their use.

With family finances, you have to open up to your kids and share your mistakes, and perhaps point out some of the judgment missteps you have made. It also invites more discussion and the need for guidance. What you do with your money isn’t nearly as clear-cut as the consequences related to drugs and alcohol.

In fact, only the ever-uncomfortable talk about the “birds and the bees” (30 percent of parents are comfortable with this topic) offered more difficulty than talking about family finances, according to the research cited by State Farm.

So what else is easier to talk about than family finances? It looks like politics and religion. Once again, I can kind of see why it might be easier to talk about these subjects with kids. You have a worldview, and it’s easier to just impart that worldview — by saying “this is the way things are — than it is to have a discussion about finances.

There are also gender differences in learning about money (well, learning about life insurance, anyway). I was pleased that 20 percent of kids learn from their fathers vs. 18 percent learning from their mothers. While it’s somewhat distressing that fathers are still seen as the place to go to for certain money discussions, I think that there has likely been something of a closing of the gap, since there isn’t a big difference.

The infographic indicates that that girls generally get their information from their mothers, while boys get their information from their dads. I’d like to see it a little more even across genders. The numbers seem to indicate that discussions about life insurance/money are not being handled jointly, but that they are being handled separately. I’d like to see more family involvement at all levels when it comes to talking money.

What do you think? What are some of the things you take away from this infographic?

Miranda is freelance journalist. She specializes in topics related to money, especially personal finance, small business, and investing. You can read more of my writing at Planting Money Seeds.